Your Mental

Health Matters

Your Mental

Health Matters

Health Matters

Transform well-being with our mental health app

Tailored solutions for individuals and businesses, promoting mental and physical health for a happier, healthier life.

We are global! Find us on all app stores

Fully multilingual content and Fluent AI language support. All employees children and loved ones get FREE Access

Your Mental

Health Matters

Your Mental

Health Matters

Health Matters

Transform well-being with our mental health app: tailored solutions for individuals and businesses, promoting mental and physical health for a happier, healthier life.

Tailored solutions for individuals and businesses, promoting mental and physical health for a happier, healthier life.

We are global! Find us on all app stores

Fully multilingual content and Fluent Ai language support. All employees children and loved ones get FREE Access

Discover Scientifically-Backed Solutions for Mental and Physical Health with Shoorah

Discover

Scientifically-Backed Solutions for Mental & Physical Health

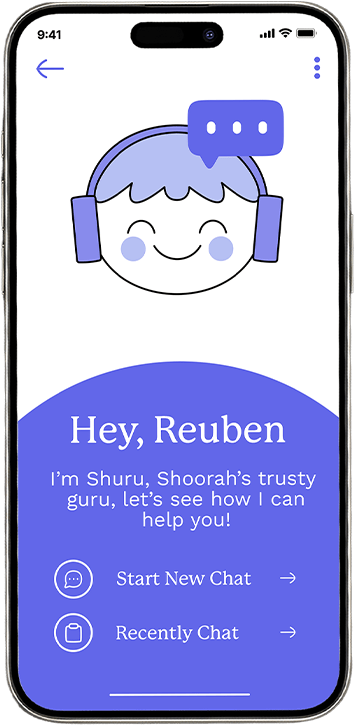

Introducing ‘Shuru’ Shoorah’s Trusted Guru

Experience accessible, confidential, and personalised mental health support with Shuru, our AI-powered therapy tool designed to help you overcome challenges and improve well-being.

Experience accessible, confidential, and personalised mental health support with Shuru, our AI-powered therapy tool designed to help you overcome challenges and improve well-being.

24/7 availability

Live Guidelines

Chat & voice sessions

AI-driven

Workouts & Recipes

Multilingual voice chat

360° Well-being Support

No delay or Cancelation

Health companion

Home Testing Kits

Be proactive about your health. Shoorah’s at-home health test kits. Our clinical quality tests are designed to reassure and provide you with more information about your personal health.

Addiction Support

Arthritis

Blood Health

Bone & Joint Health

Cancer Risk

Diabetes

Fatigue

Fertility

Gut & GI Wellness

Health Checks

Heart & Vascular Health

Hormonal Control

Immune Health

Liver Damage

Menopause

Nutrition & Metabolism

Organ Health

Sex Hormones

Sexual Health

Stress

Thyroid Health

Introducing ‘Shuru’ Shoorah’s Trusted Guru

Experience accessible, confidential, and personalized mental health support with Shuru, our AI-powered therapy tool designed to help you overcome challenges and improve well-being.

Experience accessible, confidential & personalised mental health support with Shuru.

24/7 availability

Live Guidelines

Chat & voice sessions

AI-driven

Workouts & Recipes

Multilingual voice chat

360° Well-being Support

No delay or Cancelation

Health companion

Same day therapy

Checkout our Marketplace

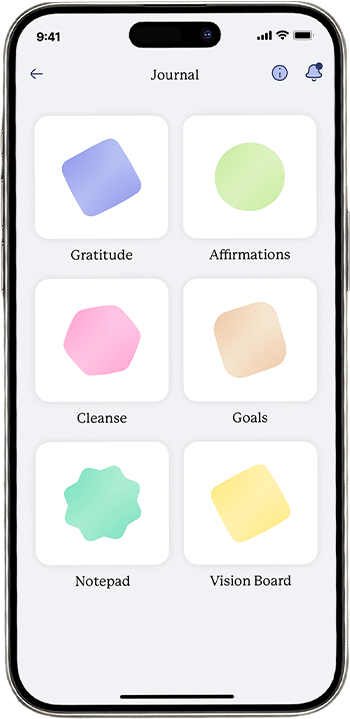

Well-being Toolkit

Explore features like journaling, guided meditations, mood tracking, rituals, sleep sounds, and Bite sized podcasts to support your mental health needs. This all-in-one toolkit empowers you to improve your overall well-being.

Explore features like journaling, guided meditations, mood tracking, rituals, sleep sounds, and Bite sized podcasts to support your mental health needs. This all-in-one toolkit empowers you to improve your overall well-being.

160 Digital Bio-Marking Tests

Covering neurodivergent, cancer pre-screening, HIV, gut intolerance, liver, kidney, male testosterone, menopause, fertility and many more.

Explore Our Transformative Features & Benefits

What is PEAP?

PEAP is a On-demand therapy and live video call service for users to speak to experts, such as, Doctors, Therapist, life coach’s and more… PEAP (Premium Employee Assistance Program) Our experts offer personalised mental health support services for businesses and individuals, promoting well-being and productivity through tailored resources and expert live guidance.

How can PEAP help?

PEAP helps by connecting businesses and individuals with mental health experts who offer personalized guidance and resources.

Is PEAP only for companies?

No, PEAP is not only for companies. Whether you are a business owner, manager, or an individual seeking mental health support, PEAP is here to help.

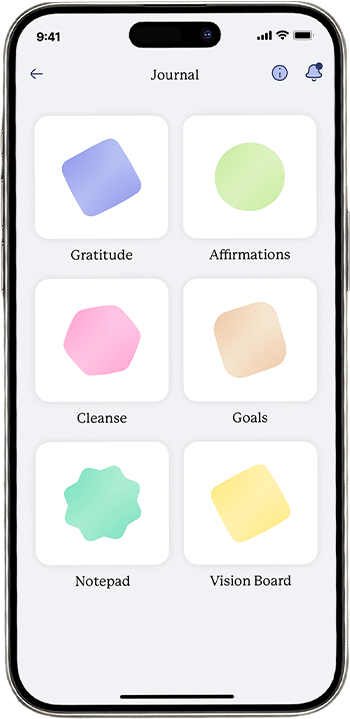

What is Self-Development?

A feature designed for goal setting, gratitude journaling, thought cleansing, daily journaling, positive affirmations, and action boarding.

How can Self-Devlopment help?

Self-Development aids in nurturing a healthy mindset, self-awareness, motivation, and goal achievement through practices that promote well-being and growth.

How often should I use it?

We recommend using the Self-Development feature regularly, such as daily or every other day, to make the most of its benefits and to create lasting habits. It depends on your needs.

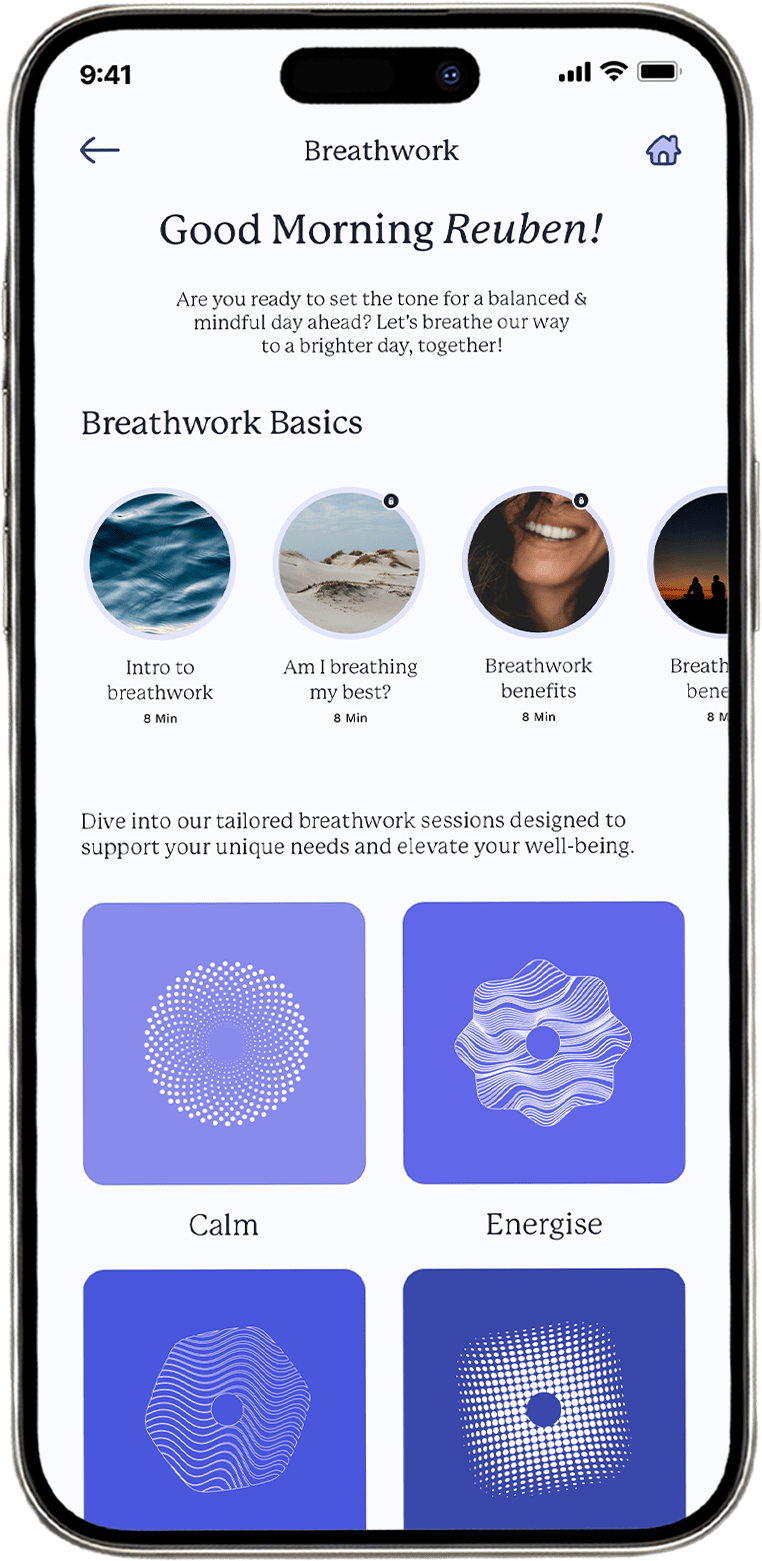

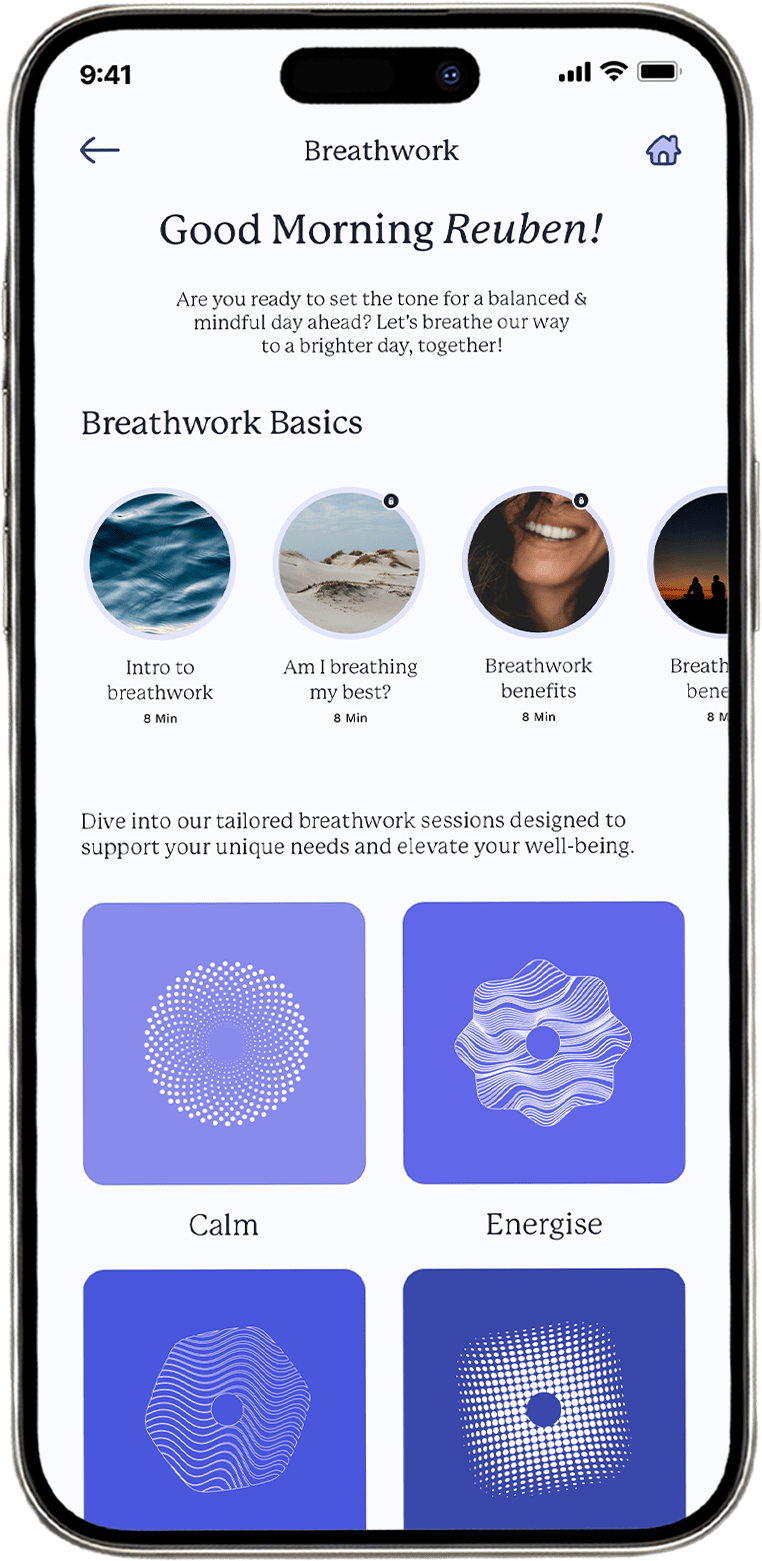

What is Breathwork?

Breathwork guides users through focused breathing exercises to promote relaxation, stress relief, and an overall sense of well-being.

How can Breathwork help?

Breathwork can help users reduce anxiety, manage stress, improve focus, and regulate emotions.

Is PEAP only for companies?

No, PEAP is not only for companies. Whether you are a business owner, manager, or an individual seeking mental health support, PEAP is here to help.

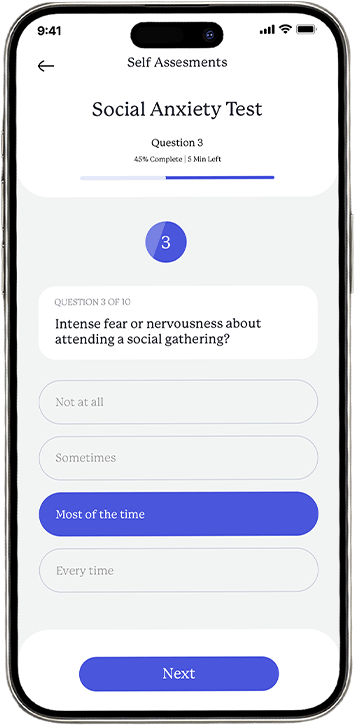

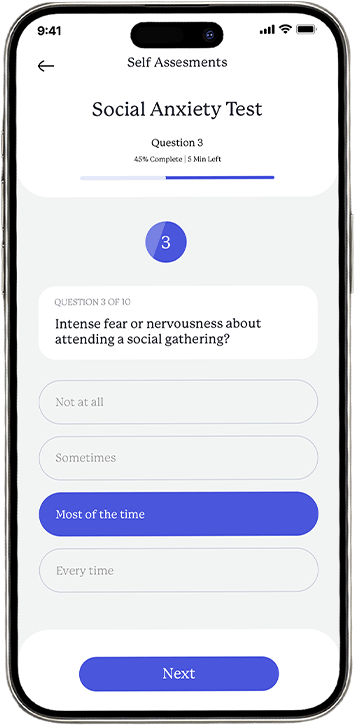

What Is Self Assessment?

Self-Assessments are easy-to-use tools designed to provide insights into your mental health and well-being. These tests cover various aspects of mental wellbeing.

How can Self Assessments help?

By deepening your understanding of your emotions and behaviours, Self Assessments guide you in seeking the right support.

Why should I use Self Assessments?

Self Assessments help you prioritise your mental health & improve wellbeing through increased self-awareness & personal growth.

What is Shuru?

Shuru is our AI therapy chat tool that offers both text and voice-based communication for users seeking mental health support.

How can Shuru help?

Shuru provides users with a safe and non judge mental space to express their thoughts and emotions.

How confidential is Shuru?

All conversations are encrypted, and user information is not shared with third parties. Users can feel secure knowing that their interactions with Shuru remain private and protected.

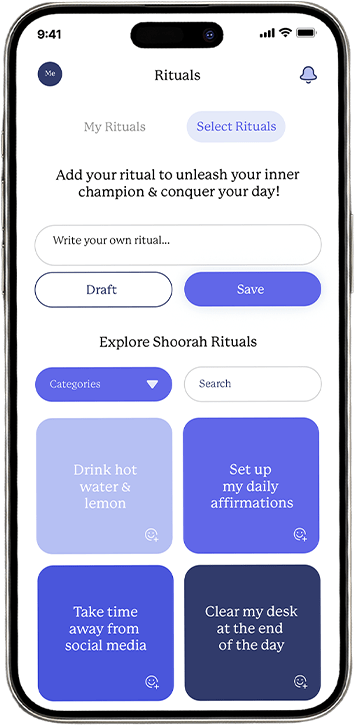

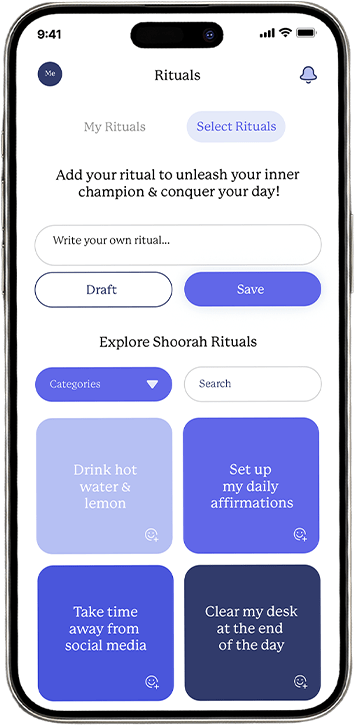

What is Rituals?

Rituals is a feature that enables users to create and maintain healthy habits and routines to support their mental well-being.

How can Rituals help?

Rituals can help users establish consistency and discipline in their daily lives, leading to improved mental health, increased self-awareness, and the development of positive habits.

Can I create custom rituals?

Yes, the Rituals feature allows users to create customised rituals tailored to their specific goals and preferences.

What is Restore?

Restore is a feature that offers a collection of meditations and sleep sounds designed to promote relaxation, stress relief, and improved sleep quality.

How can Restore help?

Restore can help users reduce anxiety, improve sleep, and cultivate mindfulness by providing calming and immersive audio experiences.

Can I download audio when offline?

Yes, Restore allows users to download their favourite meditations and sleep sounds for offline use.

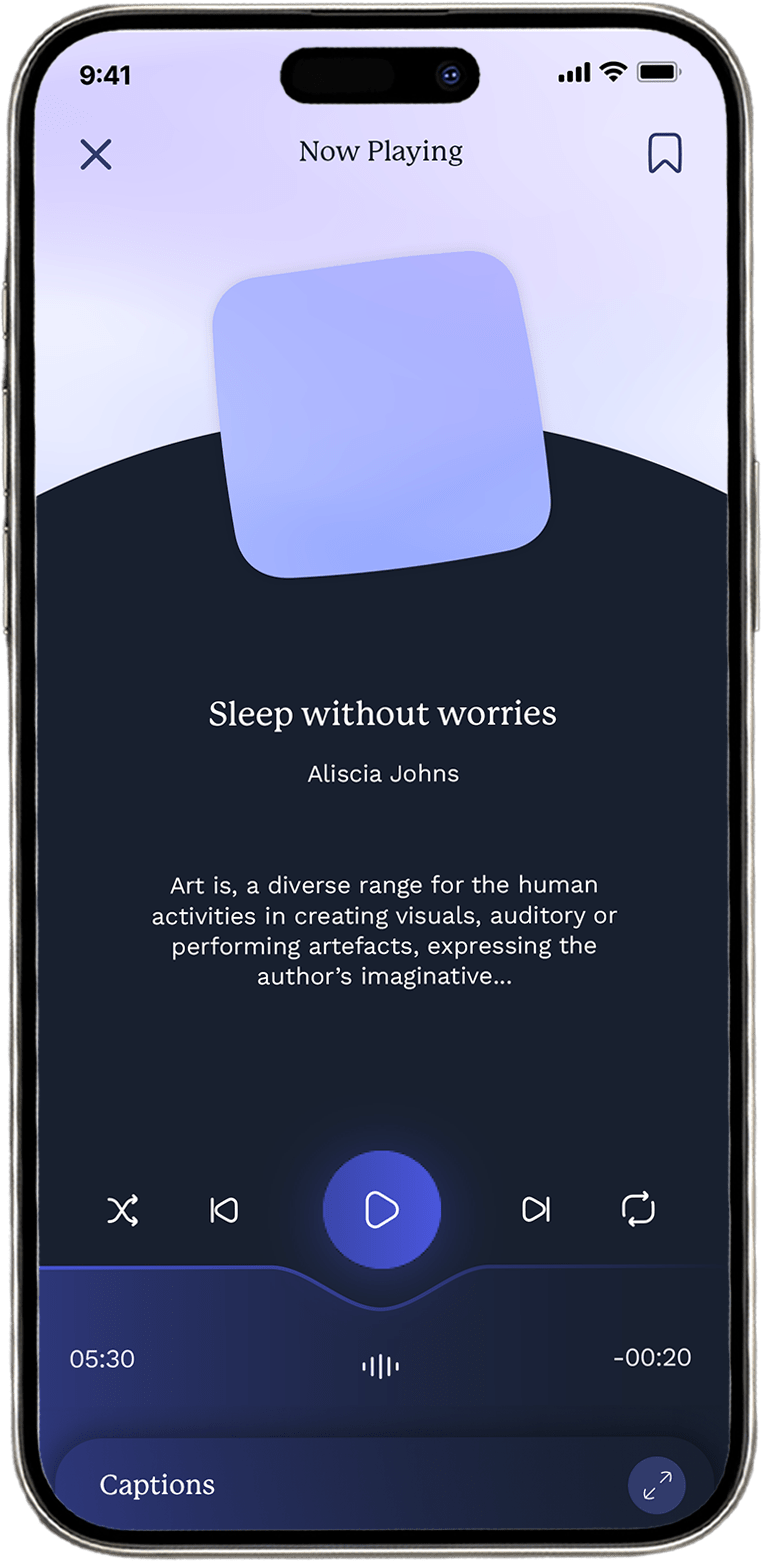

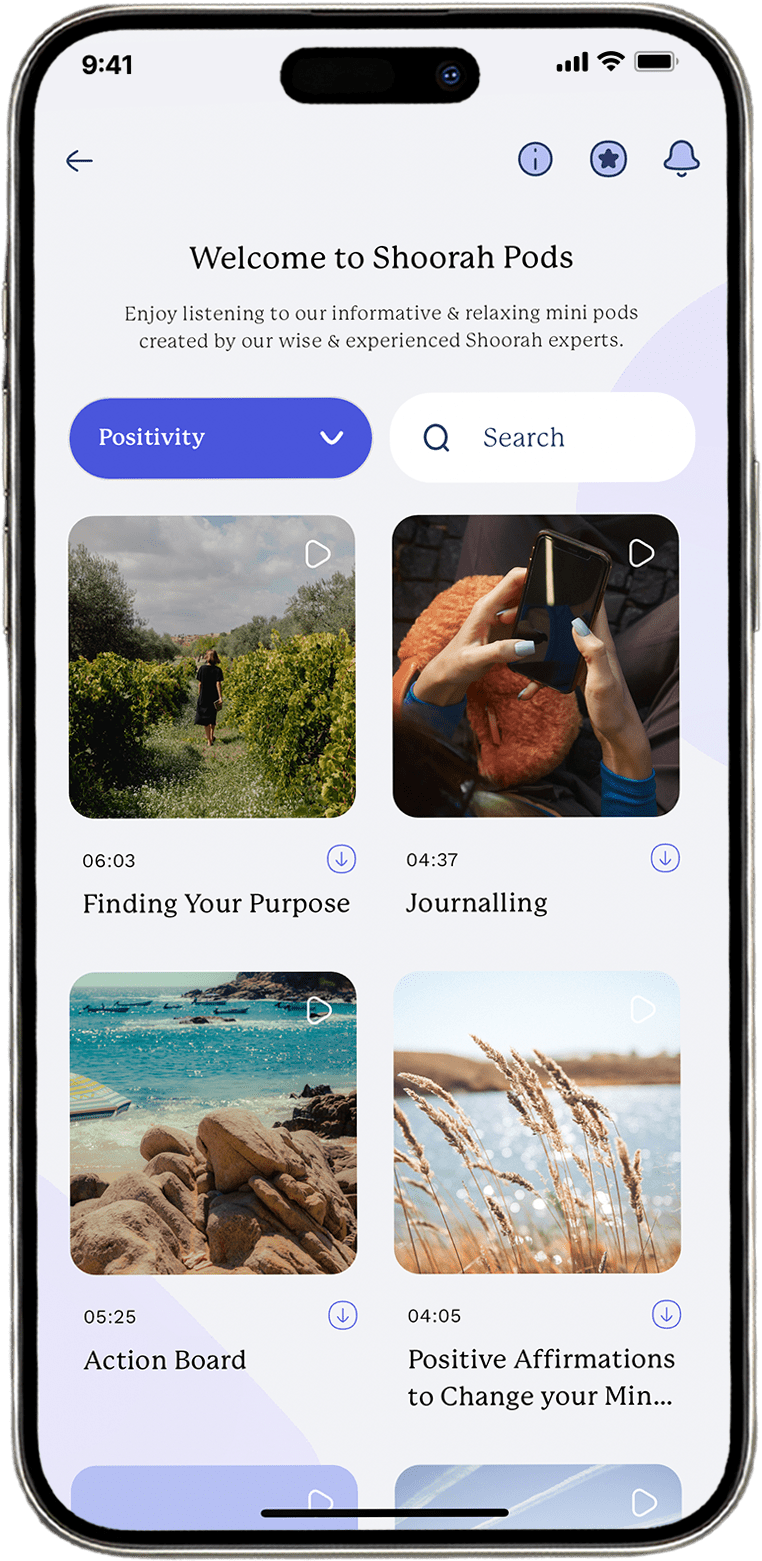

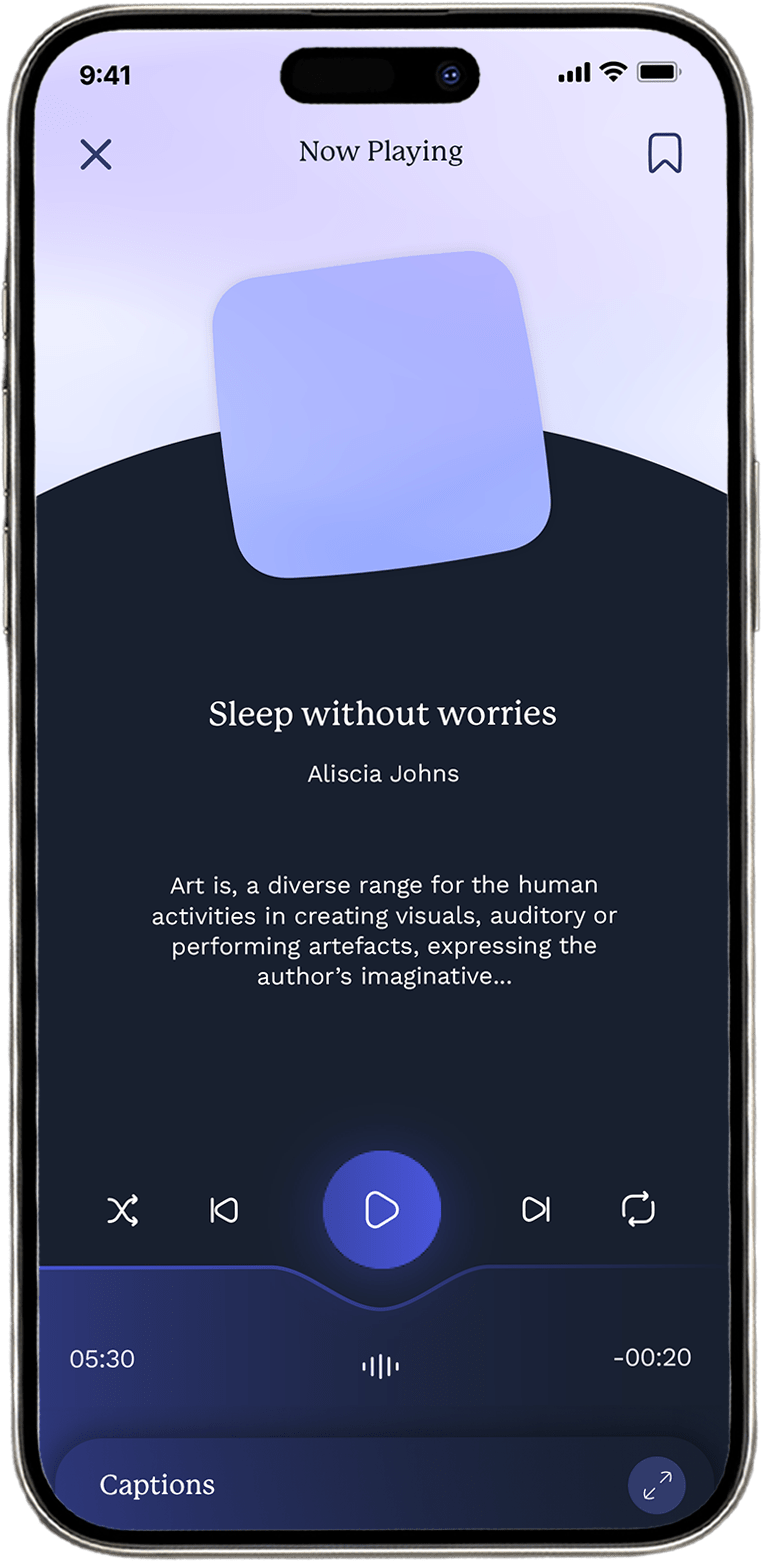

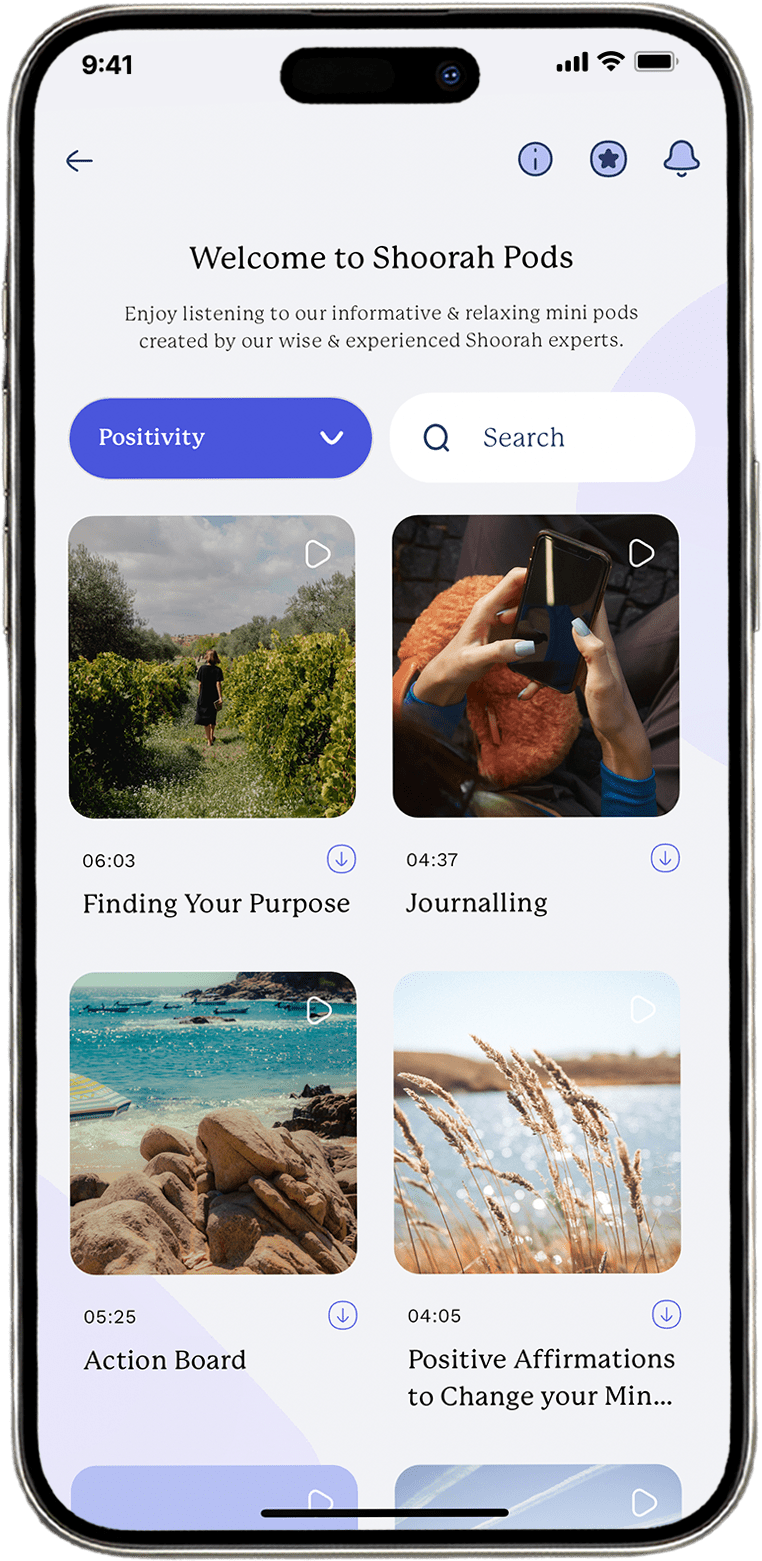

What are Shoorah Pods?

Shoorah Pods are short, informative, podcast-style audio content created by Shoorah experts. These bite-sized episodes cover various topics related to mental health & well-being.

How can Shoorah Pods help?

Shoorah Pods provide users with convenient, on-the-go learning opportunities to gain knowledge and inspiration for their mental health journey.

Why should I use Shoorah Pods?

Incorporating Shoorah Pods into your daily routine can contribute to a more well-rounded approach to self-care and personal growth.

Coming Soon

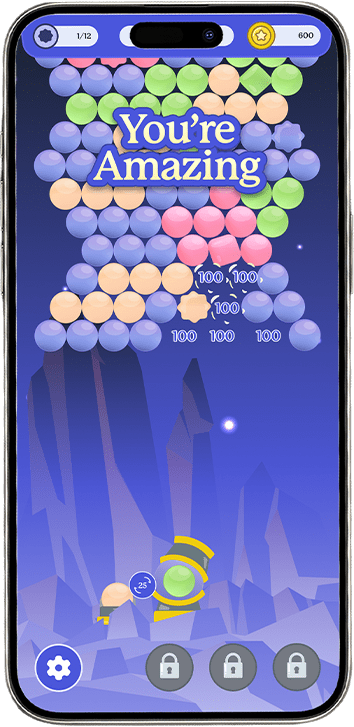

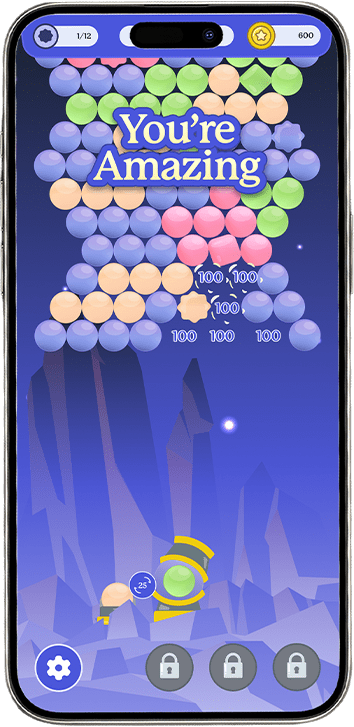

What is Affirmation Burst?

Affirmation Burst is an engaging & interactive game designed to uplift your spirit & boost your self-confidence. The game presents you with a colourful array of bubbles containing affirmations.

How can Affirmation Burst help?

Affirmation Burst serves as a fun and lighthearted way to incorporate positive affirmations into your daily routine.

Why should I use Affirmation Burst?

By using Affirmation Burst, you can create a brighter outlook, strengthen your self-belief, and foster personal growth while having fun!

What is PEAP?

PEAP is a On-demand therapy and live video call service for users to speak to experts, such as, Doctors, Therapist, life coach’s and more… PEAP (Premium Employee Assistance Program) Our experts offer personalised mental health support services for businesses and individuals, promoting well-being and productivity through tailored resources and expert live guidance.

How can PEAP help?

PEAP helps by connecting businesses and individuals with mental health experts who offer personalized guidance and resources.

Is PEAP only for companies?

No, PEAP is not only for companies. Whether you are a business owner, manager, or an individual seeking mental health support, PEAP is here to help.

What is Self-Development?

A feature designed for goal setting, gratitude journaling, thought cleansing, daily journaling, positive affirmations, and action boarding.

How can Self-Devlopment help?

Self-Development aids in nurturing a healthy mindset, self-awareness, motivation, and goal achievement through practices that promote well-being and growth.

How often should I use it?

We recommend using the Self-Development feature regularly, such as daily or every other day, to make the most of its benefits and to create lasting habits. It depends on your needs.

What is Breathwork?

Breathwork guides users through focused breathing exercises to promote relaxation, stress relief, and an overall sense of well-being.

How can Breathwork help?

Breathwork can help users reduce anxiety, manage stress, improve focus, and regulate emotions.

Is PEAP only for companies?

No, PEAP is not only for companies. Whether you are a business owner, manager, or an individual seeking mental health support, PEAP is here to help.

What is Self Assesment?

Self Assessments are easy-to-use tools designed to provide insights into your mental health and wellbeing. These tests cover various aspects of mental wellbeing.

What is Self Assesment?

By deepening your understanding of your emotions and behaviors, Self Assessments guide you in seeking the right support.

What is Self Assesment?

Self Assessments help you prioritise your mental health & improve wellbeing through increased self-awareness & personal growth.

What is Shuru?

Shuru is our AI therapy chat tool that offers both text and voice-based communication for users seeking mental health support.

How can Shuru help?

Shuru provides users with a safe and non judge mental space to express their thoughts and emotions.

How confidential is Shuru?

All conversations are encrypted, and user information is not shared with third parties. Users can feel secure knowing that their interactions with Shuru remain private and protected.

What is Rituals?

Rituals is a feature that enables users to create and maintain healthy habits and routines to support their mental well-being.

How can Rituals help?

Rituals can help users establish consistency and discipline in their daily lives, leading to improved mental health, increased self-awareness, and the development of positive habits.

Can I create custom rituals?

Yes, the Rituals feature allows users to create customised rituals tailored to their specific goals and preferences.

What is Restore?

Restore is a feature that offers a collection of meditations and sleep sounds designed to promote relaxation, stress relief, and improved sleep quality.

How can Restore help?

Restore can help users reduce anxiety, improve sleep, and cultivate mindfulness by providing calming and immersive audio experiences.

Can I download audio when offline?

Yes, Restore allows users to download their favourite meditations and sleep sounds for offline use.

What are Shoorah Pods?

Shoorah Pods are short, informative, podcast-style audio content created by Shoorah experts. These bite-sized episodes cover various topics related to mental health & well-being.

How can Shoorah Pods help?

Shoorah Pods provide users with convenient, on-the-go learning opportunities to gain knowledge and inspiration for their mental health journey.

Why should I use Shoorah Pods?

Incorporating Shoorah Pods into your daily routine can contribute to a more well-rounded approach to self-care and personal growth.

What is Affirmation Burst?

Affirmation Burst is an engaging & interactive game designed to uplift your spirit & boost your self-confidence. The game presents you with a colorful array of bubbles containing affirmations.

How can Affirmation Burst help?

Affirmation Burst serves as a fun and lighthearted way to incorporate positive affirmations into your daily routine.

Why should I use Affirmation Burst?

By using Affirmation Burst, you can create a brighter outlook, strengthen your self-belief, and foster personal growth while having fun!

Why Mental Health Matters?

This is precisely why Shoorah exists: to empower businesses and individuals alike with innovative tools, personalised guidance, and transformative resources.

1 in 4 people

In the UK experience a mental health problem each year.

£105b

Is the economic cost of mental health problems in England.

1 in 6 people

In the UK experience a mental health problem each week.

61%

Of adults with a mental health condition don’t access treatment.

1 in 4 people

In the UK experience a mental health problem each year.

£105b

Is the economic cost of mental-health problems in England.

1 in 6 people

In the UK experience a mental health problem each week.

61%

Of adults with a mental health condition don’t access treatment.

Excellent App for mental health and wellness. I recommend to all my clients.

Natalie Chambers

Trustpilot

Really helped my mental well-being. Times when I was super down and just needed that digital hug it really helped lift my spirit.

Gold Buyers

Trustpilot

Cannot fault this app , it’s amazing for your mental health , sleeping , I’ve been using this since it’s started and slept so good . Definitely worth downloading

Syreeta Kilroy

Trustpilot

Amazing app, helped with anxiety and stress levels within a few days.

Highly recommend for anyone feeling in need of support.

Kenny Sanders

Trustpilot

Great app for emotional well-being with lots of features to keep track in one useful place.

I particularly like the 24/7 therapy support section to reach out when you most need it

NB

Trustpilot

At first shoorah was just something I enjoyed but recently I suffered 4 episodes of stress hives and a major panic attack for the first time in my life and it’s now a necessity for me personally and will be invaluable for a very long time

June Livey

Trustpilot

Daisy’s mediation last night was absolutely amzing its what I really needed after a stressful week I now feel all relaxed and ready to go

Anna-Louise

Trustpilot

The app is amazing it’s helped me so much as mums got dementia when I’m stressed or struggling with my mental health i listen to the pods and meditate, i love that you can do your goals and journal, i love the app.

Larissa Georgia

Trustpilot

What I love about Shoorah is the positive quotes that you get each day to give that little reminder that you are doing your best and to not give it !! It gives me a good start to my day

Brandon

Trustpilot

I think that this app is so amazing and inspirational 💜 I can honestly say it’s been good for my mental health and made me have a positive outlook on life 🙂

Jaskiran Kaur

Trustpilot

Amazing experience and fair price. I found one of the best mental health wellness app. Nice design as well.

Makwana Parth

Trustpilot

Highly recommended for those seeking peace, clarity, and mindfulness. A true game-changer!

Deep Bhavsar

Trustpilot

Great experience. Absolutely love the short videos with positive messages. You can quickly listern to one relevant to your day. Fab app and worth every penny.

Zoe Allum

Trustpilot

Fabulous app for personal wellness and development. Amazing customer service. Highly recommend it, whether you are struggling with your mental health or just want to make time for your own development.

Danni Clarke

Trustpilot

The breath work pods & meditation really helps to reset & help you to be in the moment. Journaling daily helps see areas that are perhaps unhealthy habit mentally physically. Really helps to access self but in a non critical way. Loving all pods & how chill is.

Emma Chapman

Trustpilot

I’ve just started using Shoorah and it really is unlike any wellbeing app I’ve ever used. Already the daily affirmations are making a difference, the chance to journal and post goals etc is exactly what I need to get on track and the affirmations notifications throughout the day are exactly what I need.

Lacey Young

Trustpilot

Very easy app to navigate! The notifications of good/ positive prompts definitely help and motivate you through the lulls you get. Using the sleep sounds (good variety) can help when your mind is a million miles an hour to wind down/ help relax and sleep.

Nicki Forgham

Trustpilot

Best well-being app I have ever tried. Love the personalisation options. All the other experts are amazing and help me deeply relax any time of day. Great for breathwork, meditation, easy to use and love the daily tips and pop downs. Absolute game changer!

Daniel Moore

Trustpilot

Absolutely amazing app! Well done guys!!! For anyone who is on their own journey, and needs a friendly and easy app. This is definitely the one.

Charlotte King

Trustpilot

Shoorah has been a game-changer for our team’s wellbeing. As a social care provider, supporting our staff is a top priority, and Shoorah makes it easy with its accessible, engaging, and effective platform. The WellPoints system is a brilliant way to encourage self-care, and the 24/7 support ensures our employees always have the help they need. We highly recommend Shoorah to any organisation that truly values staff wellbeing!

Bay Care Group

Trustpilot

Meet the Dynamic & Dedicated

Individuals Behind Shoorah

Meet the Dynamic & Dedicated Individuals Behind Shoorah

Lorri Haines, a CEO with 12 years of experience, has built multiple 6-figure companies. He excels in self-development and mental health, using therapy and neuroscience insights to drive success and maintain a healthy lifestyle, with a focus on achieving excellence and realizing his vision.

Ferne McCann is a UK television personality and social media influencer. After facing personal and professional challenges, she and Lorri co-founded Shoorah to create a platform where, mental health support is easily accessible to all.

Reuben Hale is an experienced designer with a passion for purposeful design. Reuben, brings a wealth of experience across various industries, leading Shoorah’s creative vision and ensuring that design always serves a greater purpose.

Dan Lawrence is an experienced Jungian psychotherapist and social dreaming consultant. He helps explore the ‘unthought knowns’ in people’s lives, blending psychotherapy approaches with a background in derivatives trading.

Jiggs Bonafe is a dedicated professional with extensive experience in C-panel support and operations. His attention to detail and commitment to efficiency ensure that Shoorah’s operations run smoothly.

Attila Hunter is a corporate solicitor with 7+ years’ experience, specializing in media, tech, and creative industries. He advises on start-ups, agreements, acquisitions, and more, with an interest in property development.

Dr. Marc Bouji, PhD, is a cognitive neuroscience professor with 10+ years in science communication. Specialising in depression, anxiety, and neurodegenerative diseases, he leads a Biomarketing program and consults on neuromarketing.

Clive Flashman, CDO, was an early innovator in UK Knowledge Management during the dotcom boom, with work published in journals. He later rejoined the NHS, where he led the National Reporting Learning System for patient safety and contributed to WHO, HL7, and NHS Standards.

Lucinda Reader, Head of HR at Shoorah, brings broad global HR experience. She has worked with blue-chip companies and startups to drive growth, save costs, and craft post-acquisition strategies. Lucinda is known for pragmatic solutions while managing risk effectively.

Shoorah’s Cheif Medical Officer, Dr Neetu Johnson known for her roles as one of the UKs top Consultant Psychiatrist in Neurodevelopmental Disorders Integrative/Preventive Psychiatry Specialist and Longevity Medicine Lead.

Naveen Kumar, a tech leader at Shoorah, drives innovation across Android, iOS, desktop, and web apps. With 21+ projects, he ensures scalable solutions that improve mental health support through advanced features and performance optimizations.

Nicola Rain is clinical nutritionist and health specialist within an NHS background and the healthcare sector.

Ro Huntriss is a female dietician expert specializing in fertility and women’s health.

Clinician & entrepreneur passionate about healthcare innovation. I advise startups, work in the NHS, and provide expertise in clinical ops, regulation, marketing, and strategy to drive impactful solutions.

Experienced counselor specializing in anxiety, depression, ADHD, insomnia, addiction, and couples therapy. I offer personalized therapy for adults, children, and families, working privately and within the NHS.

Gary is an expert in cyber security and data protection with years of experience ensuring digital safety. He focuses on building secure systems and protecting sensitive information across all platforms.

Jay Blades oversees day-to-day operations, ensuring smooth workflow across all departments. With his strong leadership and organizational skills, he keeps projects on track and teams aligned for success.

David Sartain is a technology leader with extensive experience in managing IT infrastructure and digital innovation. He ensures that Shoorah’s technology systems are secure, efficient, and aligned with the company’s long-term goals.

Want to elevate your workplace?

Experience the benefits of our tailored mental health solutions, including PEAP, designed to improve well-being, productivity, and performance. Book a demo today to transform your organization

and empower your team!

Experience the benefits of our tailored mental health solutions, including PEAP, designed to improve well-being, productivity, and performance. Book a demo today to transform your organization and empower your team!

The Science

Behind Shoorah

Behind Shoorah

Written by Dr. Marc Bouji

Premium Employee Assistance Program

Shoorah PEAP (EAP) services revolutionize the access to well-being support. Recognizing that people are more likely to engage with resources when they're easily accessible, Shoorah offers confidential and rapid access to assessments, counseling, access to lawyers, financial advisors and all wellbeing specialists, conveniently available on users' mobile devices. Shoorah PEAP addresses a broad spectrum of personal and work-related issues affecting mental and emotional well-being where employees can seek support anytime, anywhere, empowering them to navigate challenges effectively. With PEAP, Shoorah aim to continue its work in enhancing workplace well-being, fostering a culture of support and resilience.

Shoorah Affirmations

Positive affirmations enhance mental well-being by activating brain regions related to self-esteem and motivation. Studies show daily practice reduces stress and fosters behavioural change. Shoorah encourages users to engage with affirmations for long-term emotional and mental benefits.

Soundbite

Shoorah's 5-7 minute soundbites engage users emotionally and physiologically, boosting memory and motivation. Research highlights how short audio segments improve cognition and learning, aligning with Shoorah's mission to drive its community toward positive action.

SHURU

Shuru offers instant AI-powered mental health support, providing objective guidance based on extensive data. It helps users avoid toxic thinking cycles, offering advice rooted in neuroscience. Shuru feels like a companion, guiding users through challenges with understanding and expertise.

Breathwork

Among all the techniques utilized for promoting well-being, Dr. Marc considers breathwork to stands out as the most promising easy tool with robust scientific backing. Indeed, In a randomized controlled study, that compared various breathwork exercises with mindfulness meditation over a month-long period, breathwork that emphasized on prolonged exhalations, led to greater improvements in mood and reductions in physiological stress among practicioners (Balban et. al., 2023). Additionally, a meta-analysis examining the efficacy of breathwork interventions in reducing self-reported stress, anxiety, and depressive symptoms across multiple studies showed consistent and significant benefits (Fincham et. al., 2023). Therefore Shoorah enourage you to integrate breathwork into your well-being practices for an accessible and effective stress management and mental health promotion.

Vision boards

Action (Vision) boards are great tools for personal growth, backed by neuroscience. Neuroscientists reveal that viewing images on a vision board primes the brain to recognize opportunities that may otherwise go unnoticed. Through a process of tagging, the brain prioritizes these images and elevates their importance over time by giving them an emotional value. Like learning and memorizing, regular engagement with vision board images enhances their significance, fostering tangible progress towards goal setting and manifestation. Surveys found that this is why Shoorah provides you an easy-access to a digital visual board that is user-friendly, eco-friendly without the need of sophisticated materials which ensure that your vision is with you anywhere and anytime.

Sleep sounds

Shoorah's sleep sounds improve sleep quality by enhancing deep sleep and reducing the time to fall asleep. Studies show relaxing sounds promote calmness and faster sleep onset, helping users wake up refreshed and energised for the day ahead.

Meditation

Shoorah meditation supports brain health by increasing gray matter and improving connectivity between regions involved in attention and stress regulation. Regular practice reduces amygdala activity and enhances emotional control, promoting a calmer, more focused mind.

Journaling

Journaling reduces stress and anxiety, with 68% of studies showing positive mental health outcomes. Neuroscientific research confirms reduced activity in the amygdala, lowering fear and stress responses. Shoorah encourages journaling for a more relaxed, content mind.

Shoorah Rituals

Shoorah supports daily routines that enhance self-control and reduce stress. Neuroscience shows rituals alter brain activity, increasing prefrontal cortex engagement and reducing amygdala responses. These changes lead to better cognitive performance and emotional well-being.

Affirmation Burst Game

Positive affirmations have been demonstrated to improve mental well-being and restore self-competence by allowing individuals to reflect on their core values and sources of self-worth. On the other hand, gaming and fun experiences stimulate the release of dopamine, a neurotransmitter associated with motivation and reward, which enhances learning and memory. That is why, we, at Shoorah decided to incorporate positive affirmations into a game in order to foster a positive emotional state that increases brain’s receptiveness and internalization of affirmations. This synergistic approach between fun and affirmations was shown to improve the effectiveness of affirmations and promote lasting positive change (Bowen et al., 2014; Cascio et al., 2016)

Premium Employee Assistance Program

Shoorah PEAP (EAP) services revolutionize the access to well-being support. Recognizing that people are more likely to engage with resources when they're easily accessible, Shoorah offers confidential and rapid access to assessments, counseling, access to lawyers, financial advisors and all wellbeing specialists, conveniently available on users' mobile devices. Shoorah PEAP addresses a broad spectrum of personal and work-related issues affecting mental and emotional well-being where employees can seek support anytime, anywhere, empowering them to navigate challenges effectively. With PEAP, Shoorah aim to continue its work in enhancing workplace well-being, fostering a culture of support and resilience.

Shoorah Affirmations

Positive affirmations enhance mental well-being by activating brain regions related to self-esteem and motivation. Studies show daily practice reduces stress and fosters behavioural change. Shoorah encourages users to engage with affirmations for long-term emotional and mental benefits.

Soundbite

Shoorah's 5-7 minute soundbites engage users emotionally and physiologically, boosting memory and motivation. Research highlights how short audio segments improve cognition and learning, aligning with Shoorah's mission to drive its community toward positive action.

SHURU

Shuru offers instant AI-powered mental health support, providing objective guidance based on extensive data. It helps users avoid toxic thinking cycles, offering advice rooted in neuroscience. Shuru feels like a companion, guiding users through challenges with understanding and expertise.

Breathwork

Among all the techniques utilized for promoting well-being, Dr. Marc considers breathwork to stands out as the most promising easy tool with robust scientific backing. Indeed, In a randomized controlled study, that compared various breathwork exercises with mindfulness meditation over a month-long period, breathwork that emphasized on prolonged exhalations, led to greater improvements in mood and reductions in physiological stress among practicioners (Balban et. al., 2023). Additionally, a meta-analysis examining the efficacy of breathwork interventions in reducing self-reported stress, anxiety, and depressive symptoms across multiple studies showed consistent and significant benefits (Fincham et. al., 2023). Therefore Shoorah enourage you to integrate breathwork into your well-being practices for an accessible and effective stress management and mental health promotion.

Vision boards

Action (Vision) boards are great tools for personal growth, backed by neuroscience. Neuroscientists reveal that viewing images on a vision board primes the brain to recognize opportunities that may otherwise go unnoticed. Through a process of tagging, the brain prioritizes these images and elevates their importance over time by giving them an emotional value. Like learning and memorizing, regular engagement with vision board images enhances their significance, fostering tangible progress towards goal setting and manifestation. Surveys found that this is why Shoorah provides you an easy-access to a digital visual board that is user-friendly, eco-friendly without the need of sophisticated materials which ensure that your vision is with you anywhere and anytime.

Sleep sounds

Shoorah's sleep sounds improve sleep quality by enhancing deep sleep and reducing the time to fall asleep. Studies show relaxing sounds promote calmness and faster sleep onset, helping users wake up refreshed and energised for the day ahead.

Meditation

Shoorah meditation supports brain health by increasing gray matter and improving connectivity between regions involved in attention and stress regulation. Regular practice reduces amygdala activity and enhances emotional control, promoting a calmer, more focused mind.

Journaling

Journaling reduces stress and anxiety, with 68% of studies showing positive mental health outcomes. Neuroscientific research confirms reduced activity in the amygdala, lowering fear and stress responses. Shoorah encourages journaling for a more relaxed, content mind.

Shoorah Rituals

Shoorah supports daily routines that enhance self-control and reduce stress. Neuroscience shows rituals alter brain activity, increasing prefrontal cortex engagement and reducing amygdala responses. These changes lead to better cognitive performance and emotional well-being.

Affirmation Burst Game

Positive affirmations have been demonstrated to improve mental well-being and restore self-competence by allowing individuals to reflect on their core values and sources of self-worth. On the other hand, gaming and fun experiences stimulate the release of dopamine, a neurotransmitter associated with motivation and reward, which enhances learning and memory. That is why, we, at Shoorah decided to incorporate positive affirmations into a game in order to foster a positive emotional state that increases brain’s receptiveness and internalization of affirmations. This synergistic approach between fun and affirmations was shown to improve the effectiveness of affirmations and promote lasting positive change (Bowen et al., 2014; Cascio et al., 2016)

Frequently Asked Questions

- For iOS (Apple devices):

- Open the Settings app.

- Tap your name at the top of the screen.

- Select Subscriptions.

- Choose the subscription you want to cancel and tap Cancel Subscription.

- For Android (Google Play):

- Open the Google Play Store app.

- Tap the Menu icon (three horizontal lines) and select Subscriptions.

- Find the subscription you wish to cancel and tap Cancel Subscription.

Our Charitable Partnerships that Make a Difference

Our Charitable Partnerships that Make a Difference

RSP, founded by Alice Hendy in response to personal tragedy, is dedicated to fostering a safer online space for those facing mental health challenges. Their R;pple browser extension detects harmful content and provides resources to support individuals in distress.

Nacoa is a UK charity established in 1990, offering support and resources to individuals of all ages affected by parental alcohol addiction through their confidential helpline and other vital services.

We’re Nurturing Nature

Join our mission to make a difference: for every app purchase, we plant a tree in Haiti or Kenya, helping reduce carbon emissions and create a healthier planet. 29 tonnes reduced so far!

Sleep Check-In

Daily Rituals

![]()

Sleep Check-In

Breathwork

Shoorah Pods

Daily Rituals

Daily Journal

Change in your pocket

Vision Board

![]()

Mood Tracker

Mental Health Insights & Inspiration

What Your Attachment Style Says About You?

Workplace Wellbeing In Decline – Shoorah Has The Solution

Improving your well-being through self-kindness

The Power of Your Breath: A Path to Mental Health and Wellbeing

Join Our Newsletter

Subscribe to our newsletter to receive exclusive updates, insights, and resources on mental health, resilience, and personal growth. Stay connected with our community and join the conversation

on fostering a happier, healthier life.

Subscribe to our newsletter to receive exclusive updates, insights, and resources on mental health, resilience, and personal growth. Stay connected with our community and join the conversation on fostering a happier, healthier life.

Adding {{itemName}} to cart

Added {{itemName}} to cart